Ad Details

-

Ad ID: 97884

-

Added: July 10, 2025

-

Views: 5

Description

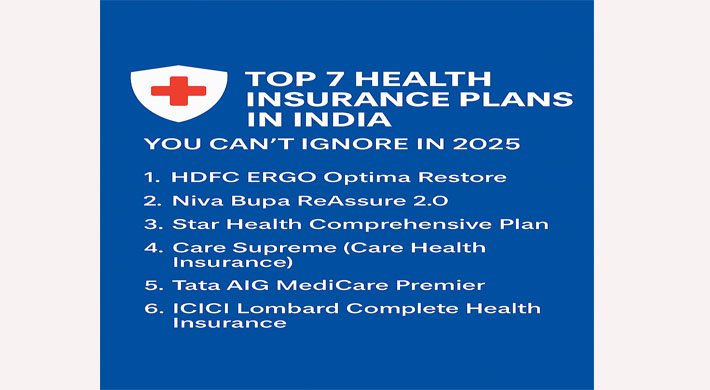

Healthcare costs are rising fast—and 2025 is no exception. A solid health insurance policy isn’t optional anymore. It’s your financial safety net.

But with hundreds of plans out there, which ones actually deliver?

We’ve reviewed, compared, and shortlisted the 7 best health insurance plans in India for 2025—based on coverage, premium, claim settlement, and real-world value.

Health Insurance Plans –

1. HDFC ERGO Optima Restore

-

Sum Insured: ₹5 – ₹50 lakh

-

Key Feature: Automatic sum insured restore (even if used once)

-

Why It Stands Out: Great for individuals and families, fast claim settlement, strong hospital network

2. Niva Bupa ReAssure 2.0

-

Sum Insured: ₹5 lakh – ₹1 crore

-

Key Feature: Unlimited reinstatement of cover + booster benefits

-

Why It Stands Out: Excellent for high medical costs, especially with lifestyle-related diseases rising

3. Star Health Comprehensive Plan

-

Sum Insured: ₹5 lakh – ₹1 crore

-

Key Feature: Includes maternity & newborn cover, no capping on room rent

-

Why It Stands Out: Ideal for families and young couples planning for the future

4. Care Supreme (Care Health Insurance)

-

Sum Insured: ₹5 lakh – ₹75 lakh

-

Key Feature: Zero deduction on claims, wellness rewards

-

Why It Stands Out: Good for preventive care + strong digital servicing

5. Tata AIG MediCare Premier

-

Sum Insured: ₹5 lakh – ₹3 crore

-

Key Feature: Global coverage, organ donor expenses covered

-

Why It Stands Out: Perfect for frequent travelers and NRIs with family in India

6. ICICI Lombard Complete Health Insurance

-

Sum Insured: ₹5 lakh – ₹50 lakh

-

Key Feature: Optional maternity & OPD add-ons, unlimited teleconsults

-

Why It Stands Out: Balanced plan with broad customization options

7. Aditya Birla Activ Health Platinum Enhanced

-

Sum Insured: ₹5 lakh – ₹2 crore

-

Key Feature: Chronic management, wellness rewards, HealthReturns

-

Why It Stands Out: Great for people with pre-existing conditions or lifestyle diseases

How to Choose the Right Health Insurance in 2025

✔️ Look beyond premiums

Focus on sum insured, claim ratio, and hospital network.

✔️ Check waiting periods

For pre-existing conditions, maternity, etc.

✔️ Consider add-ons

OPD, critical illness, and room rent flexibility can matter long-term.

✔️ Think family-first

Go for family floater plans if you’re covering multiple members.

MORE On Health Insurance

Final Word: Secure Your Health, Secure Your Wealth

A medical emergency can wipe out years of savings. With the right health insurance policy, you don’t just save money—you buy peace of mind.

In 2025, these 7 plans offer top-tier protection, flexibility, and value.

Leave a Comment

Your email address will not be published. Required fields are marked. *